- SMB Signal by Mainshares

- Posts

- 📡 SMB Signal: Digital marketing agency, metal fabrication and solar contracting deal

📡 SMB Signal: Digital marketing agency, metal fabrication and solar contracting deal

Plus, raising $1M in capital from Mainshares investors and how to buy a business for $1

Hello, and welcome to 📡 SMB Signal by Mainshares! Each week, we spotlight high-quality small business deals, operator insights, and tactical playbooks for buying, running, or investing in Main Street businesses. Join 12,000+ investors and operators staying sharp and deal-ready.

🔍 What’s in the Deal Depot?

Looking to invest? Check out some of the latest SMB investment opportunities. 👉 Sign up on Mainshares to access live deal details.

Tech-Enabled Metal Fabrication Services

📈 Investment Opportunity

Location: California

Cash Flow: $4M

LTM Revenue: $35M

TLDR: This industrial roll-up is acquiring tech-enabled metal fabricators in a $30B+ fragmented sector, targeting real estate-rich, under-modernized shops. With 3 acquisitions closed and 5 more in the pipeline, the company is on track to reach $140M in revenue by 2029. Led by experienced operators, the team is raising $3M in preferred equity (12% return, with stepped-up common upside) to fuel continued M&A-driven growth.

Why is this interesting?

Clear path to scale—Targeting $50M revenue / $6M EBITDA by 2026 and $140M / $29M by 2029 by using a repeatable playbook of platform and tuck-in acquisitions.

Strategic California footprint—Starting in the nation’s largest manufacturing state, the company is building regional density (OC, LA, Bay Area), unlocking operational leverage and stronger margins.

Modernization meets opportunity—Leveraging centralized ops and tech tools to transform legacy shops into efficient, scalable, high-margin businesses in a sector ripe for consolidation.

Digital Marketing Agency

📈 Investment Opportunity

Location: New York

Cash Flow: $470K

LTM Revenue: $1.6M

TLDR: This agency is a proven digital marketing firm specializing in SEO and PPC, with strong client retention, especially in the dental sector. Generating $1.7M revenue and nearly $470K EBITDA, it offers investors a chance to buy into a scalable, high-margin business positioned to capitalize on rapid digital marketing growth within a $12B market. This deal structure offers leveraged upside, creating a capital-efficient path into a high-margin, recurring revenue business.

Why is this interesting?

Massive untapped market opportunity—Currently serving just 0.1% of the $12B U.S. dental market, with clear expansion potential into adjacent sectors like Chiropractic, Dermatology, and MedSpas.

Predictable recurring revenue—Retainer-based contracts with consistent monthly cash flow supporting scalable growth and stable returns.

Looking to acquire? Every week, we post new acquisition deals in the Mainshares Network for our community members. If you’re actively searching, 👉 create a Buyer Profile to unlock deal flow, or email us to learn more about a specific opportunity.

Residential & Commercial Landscaping Contractor

🔑Buyer Opportunity

Location: Big Bear Lake, California

Founded Year: 1979

TTM Revenue: $2.1M

TTM SDE: $780K

TLDR: This business is a full-service landscape contractor offering design, installation, and maintenance to high-end residential and commercial clients across Big Bear Valley. With a 45-year history, a loyal customer base, and minimal competition, the company is a well-run, lifestyle business with significant expansion potential in adjacent markets and services.

Why is this interesting?

Long-term relationships and word-of-mouth growth—No marketing spend; 90%+ of clients are repeat or referral-based, with many dating back decades.

Diversified services—Revenue split between landscape construction (56%), maintenance (41%), and arborist/design services (3%) ensures recurring work and seasonal balance.

Efficient operations—All customers are within 8 miles of HQ, enabling low vehicle usage and streamlined route planning.

Tenured team—25 staff, including a superintendent (20 years) and experienced crew leaders, providing continuity for a new owner.

Solar Energy Design & Installation Contractor

🔑Buyer Opportunity

Location: Illinois

Founded Year: 1991

TTM Revenue: Not disclosed

TTM SDE: $550K

TLDR: This business is a boutique solar contractor with over 30 years of experience in residential and commercial solar installations. Operating with low overhead through subcontractors and vendor relationships, the business is built around a consultative sales approach and project-specific design, with opportunity for geographic or digital growth.

Why is this interesting?

Streamlined and scalable model—No inventory or warehousing; projects are fulfilled on-demand via key vendor and subcontracted labor.

Vendor-financed growth potential—Net 90 payment terms with primary supplier support, healthy cash flow and reduced capital constraints.

Owner-led sales and collections—High-touch client engagement leads to trusted relationships and low churn.

Transition support available—Owner willing to stay on and train buyer in all aspects of the business, from sales strategy to operations.

Deal summaries above are for informational purposes only. Detailed financials and confidential information are shared only with vetted buyers under an executed NDA.

🎥 Upcoming events

🗓️ Thursday, July 31

👤Host: Jed Morris, Managing Partner at Sunset Coast Partners

🕛 12 PM CT / 1 PM ET

👉Register now

Acquiring a business can be one of the most rewarding — and risky — moves an entrepreneur can make. In this candid session, Jed Morris breaks down what really happens when things don’t go according to plan. From deals that fall apart last-minute to post-close surprises that catch even seasoned operators off guard, we’ll explore the common pitfalls and how to prepare for the unexpected.

Whether you're in diligence, under LOI, or just starting your search, this is a must-attend for anyone serious about navigating the rougher waters of SMB acquisition.

🔑 Top questions asked this week

Every week, we pull real questions straight from Mainshares Network, where small business buyers, investors, and operators swap notes, deals, and advice in real time. Here are some of the top insights from the week.

How do you determine your LOI offer price?

Q: From the #AskSMB channel

A: Thomas (Mainshares Network Member)

I would NOT recommend looking at a ratio of asking price to offer as a basis for your offer. You have to come up with what the business is worth to you.

Most times, this will be a multiple of verifiable cash flow or some asset value. You will most likely have your own “synergies” or improvements you will make as part of your ownership. Those are yours; that is the value you bring to the business. That is the logic part of the deal, after that it all goes out the window.

Your seller has a value in their head. They often have asset values greater than the offer you are willing to make. They mistake this mythical value with what you should pay, but it cannot work like that. You have to utilize those assets to make cash to pay the bills and the debt and the lease, etc.

Remember, the seller has emotions attached in a very high % of the deals. If they have an advisor, they may be a little better, but I have found that most business brokers do little to actually help their clients stay realistic. This is inversely proportional to the size of the deal. As it gets larger, you usually get better, more rational discussion of values. Deal excitement and unrealistic expectations causes most deals to either not get done or get done at unsustainable prices.

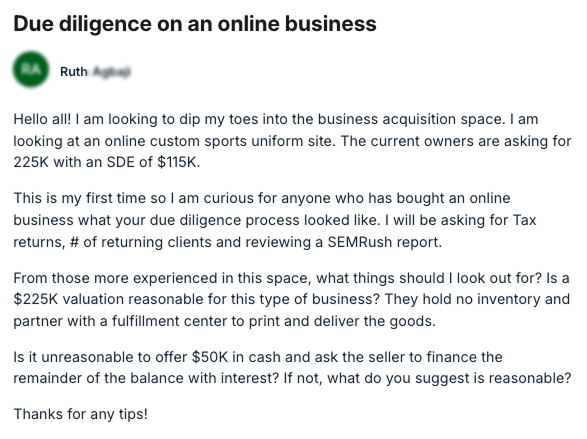

How do you do due diligence for an online business?

Q: From the #AskSMB channel

A: Josh (Mainshares Network Member)

Max 2x cash flow for a small ecomm operation so that’s in-line. I would definitely look at tax returns as you suggested (for the business), but I’d also request access to every sales and spend channel to run the reports and validate the numbers you’re seeing on the P&L.

For sales channels: Shopify (or their DTC platform), Amazon, eBay, Pinterest, Walmart

For spend channels: the marketplace ad accounts, Google Ads and Meta Ads

That should allow you to align the majority of sales and expenses to their financials.

Got a question? Submit your question in the community!

📑 More Resources

Ben Heah and J.Y. Chia raise over $1M in capital from Mainshares investors 👉 Read the case study

What investors look for in small business searchers 👉 Read the article

How to Buy a Business for $1 👉 Read the article

Buy vs. Build: Should you buy or start a plumbing business? 👉 Read the article

🎙️ Latest SMB15 episode

Join 3,000+ SMB buyers, investors, and advisors building Main Street businesses

Get access to vetted deal flow, live workshops, and a private network of people serious about SMB acquisition.