- SMB Signal by Mainshares

- Posts

- 📡 SMB Signal: Property restoration, waste management, and construction consulting businesses

📡 SMB Signal: Property restoration, waste management, and construction consulting businesses

Plus, how investors evaluate deals and interview with a 3D print farm operator

Hello, and welcome to SMB Signal by Mainshares! Each week, we spotlight high-quality small business deals, operator insights, and tactical playbooks for buying, running, or investing in Main Street businesses.

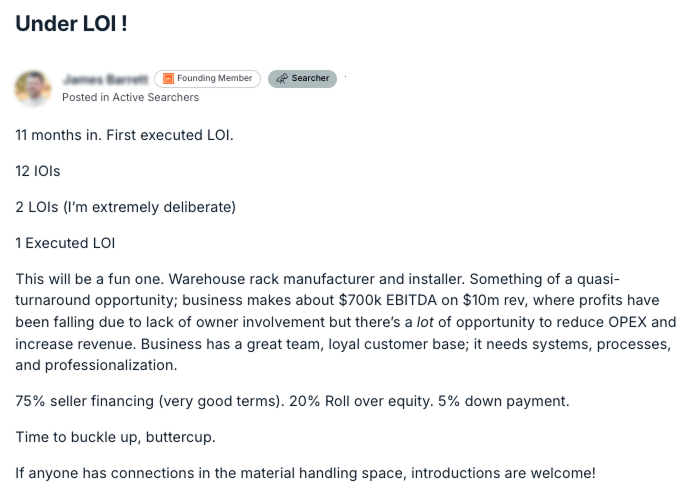

🎉 Community Win

Check out this win shared by a member in the Mainshares Network!

Want to get matched with acquisition opportunities?

Every week, we source, review, and vet hundreds of on- and off-market business acquisition deals. If you’re a skilled operator looking to buy and own a business, create a Buyer Profile (or update your existing account) to get matched with opportunities that fit your criteria.

🔍️ This Week’s Featured Deals

If you are interested in one of these featured deals, create a Buyer Profile and get in touch with us at [email protected].

🔑 Emergency Property Restoration Business

Location: Fairfield County, CT

Founded: 2018

Revenue (2025): $3.3M

SDE (2025): $1.8M

Employees: 7

A fast-growing restoration services company providing water, fire, and mold damage remediation to residential and commercial clients. Operates with a semi-absentee owner and a strong reputation in the local market, driven by digital presence and referral networks. Proven systems and strong financials make this a compelling acquisition in a recession-resistant industry.

Why is this interesting?

High-margin model: SDE margins exceed 50%, with owner only working 10–15 hours/week.

Established lead flow: Strong referral network and online visibility drive consistent demand.

Semi-absentee operations: Fully documented systems and trained team in place.

Scalable platform: Potential to expand service lines, enter nearby geographies, or roll-up similar firms.

Minimal client concentration: Mix of residential, commercial, and insurance-based work.

🔑 Specialized Trucking & Waste Services Company

Location: Maricopa County, AZ

Founded: 1986

Revenue (2024): $9.5M

SDE (2024): $1.2M

Employees: 35

Asking Price: $4.9M

An Arizona-based material handling and trucking company specializing in construction cleanup, dairy waste removal, and soil fertilization services. With nearly four decades of operation, this second-generation company has become a go-to vendor for general contractors and agricultural operations across the state. Optional real estate holdings include a 4.5-acre maintenance and operations facility.

Why is this interesting?

Diverse revenue mix: Construction (75%), agriculture (20%), specialty work (5%).

Asset-heavy with real estate: 42-truck fleet, onsite mechanics, and shop space included.

Long-standing operations: Trusted reputation since the 1980s with a repeat client base.

Growth levers: Expand capacity, market regionally, or develop environmental services.

Optional property purchase: Industrial-zoned land available for lease or sale.

🔑 Construction Engineering & Consulting Firm

Location: Central Florida

Founded: 12 years ago

Revenue (2024): $5.3M

SDE (2024): $1M

Employees: 30

Asking Price: $5M

Established construction consulting and engineering firm providing structural/civil engineering, site planning, permitting, inspections, and compliance services to commercial and residential clients. The firm has a loyal client base, steady contracts, and a team of licensed professionals in place. Offers immediate scale for an individual or strategic buyer.

Why is this interesting?

Recurring project flow: Strong referral business with contracts in pipeline.

Technical expertise: Skilled engineers and consultants, minimal owner dependency.

Turnkey operations: Proven systems, vendor relationships, and track record in place.

High-margin cash flow: Over $1M in SDE from $5.3M in revenue.

Growth potential: Expand geographically, layer new services, or market more aggressively.

Deal summaries above are for informational purposes only. Detailed financials and confidential information are shared only with vetted buyers under an executed NDA.

🎥 Upcoming events

Join experienced SMB investor, Jason Ehrlich, for a live deal review

In this live session, Jason will walk through a real deal example—breaking down what makes it interesting, what gives him pause, and how he analyzes operator fit, financials, and return potential. You’ll learn how investors actually think, what red flags to watch for, and how to sharpen your own instincts when reviewing deals.

Whether you're actively searching or closing in on an LOI, this is your chance to see the deal evaluation process from the other side of the table.

💡 Operator Tip: Personalized Customer Service Wins Every Time

“Right now, I’m still committed to over the phone quote calls”, says Julia Callahan, founder of Jubilee Cleaning.

While many cleaning businesses prioritize efficiency with online quotes, Julia knows there’s something special about that first conversation. It builds trust, sets the tone for the relationship, and helps her understand each customer’s needs to offer a flexible solution.

These personalized touches may take a little extra time, but they pay off through stronger client relationships, repeat business, and referrals.

Watch the full interview with Julia Callahan and how she scaled her cleaning business to $70k/month in less than a year.

🎙️ Interview With an Owner-Operator: 3D Print Farm

📑 More Resources

Leveraging a Sale-Leaseback for Real Estate in a Business Acquisition 👉 Read the article

A Buyer’s Guide to the Letter of Intent (LOI) + Free Template 👉 Get the guide

From Interest to Action: Taking the Next Step in Your Acquisition Journey 👉 Read the article

The Skilled Labor Crisis in America’s Reshoring Efforts 👉 Read the article

Join a network of SMB operators, investors, and owners buying and building Main Street businesses

Get access to vetted deal flow, live workshops, and a private network of people serious about SMB acquisition.