- SMB Signal by Mainshares

- Posts

- Fit Due Diligence: Are You The Right Buyer For That Business?

Fit Due Diligence: Are You The Right Buyer For That Business?

A practical framework for buyers to evaluate if they’re the right operator for the business

This article is pulled from a live workshop with Bhushan Lele, “Which Business Should You Actually Buy? Let AI Help You Decide”. Special thanks to him for providing his insights! Join upcoming live workshops in the Mainshares Network.

I’ve been an entrepreneur for 15 years. In that time, I’ve started three businesses and bought three. Some were good fits, some were terrible fits. One of them drained me so badly that I started getting heart palpitations. Another was the perfect business, but at the wrong time in my life. Two I still run today, because they actually fit me.

And here’s what I’ve learned: most businesses don’t “fail” in the way people think. They get abandoned. A business owner walks away not because demand dried up or competition killed them, but simply because it didn’t fit them as a CEO.

That’s why, before you look at revenue multiples or debt terms, you need to ask yourself one question: Will I be working for the business, or will the business be working for me?

When you buy a small business, your owner’s benefit usually gets cut in half overnight. You’re taking on loan payments, higher insurance, and extra staff. To get back to a sustainable income, you have to grow the business.

Maintaining a business is one thing. Growing it is a whole different skill set. And whether you can grow it depends almost entirely on whether you have a good fit with the business.

Most people ignore this. They buy first, then try to figure it out later. That’s a recipe for burnout, resentment, and sadly, walking away from their unfulfilled goals.

So I created a framework I call Fit Due Diligence (FitDD). Traditional due diligence (DD) is about finances, legal, and operations. FitDD is about strategically leveraging you—your strengths, your stress tolerance, and your ability to thrive in the daily grind of that specific business.

FitDD boils down to evaluating fit in 3 areas:

The Grit Fit–Will you have the resilience and perseverance to see this business through?

The CEO Fit–Are you the right person to lead and manage this business?

The Opportunity Fit–Are your personal and financial resources aligned with the potential risks and rewards of this opportunity?

In this article, I’ll focus on the CEO Fit, the one most buyers underestimate.

Solving For CEO Fit

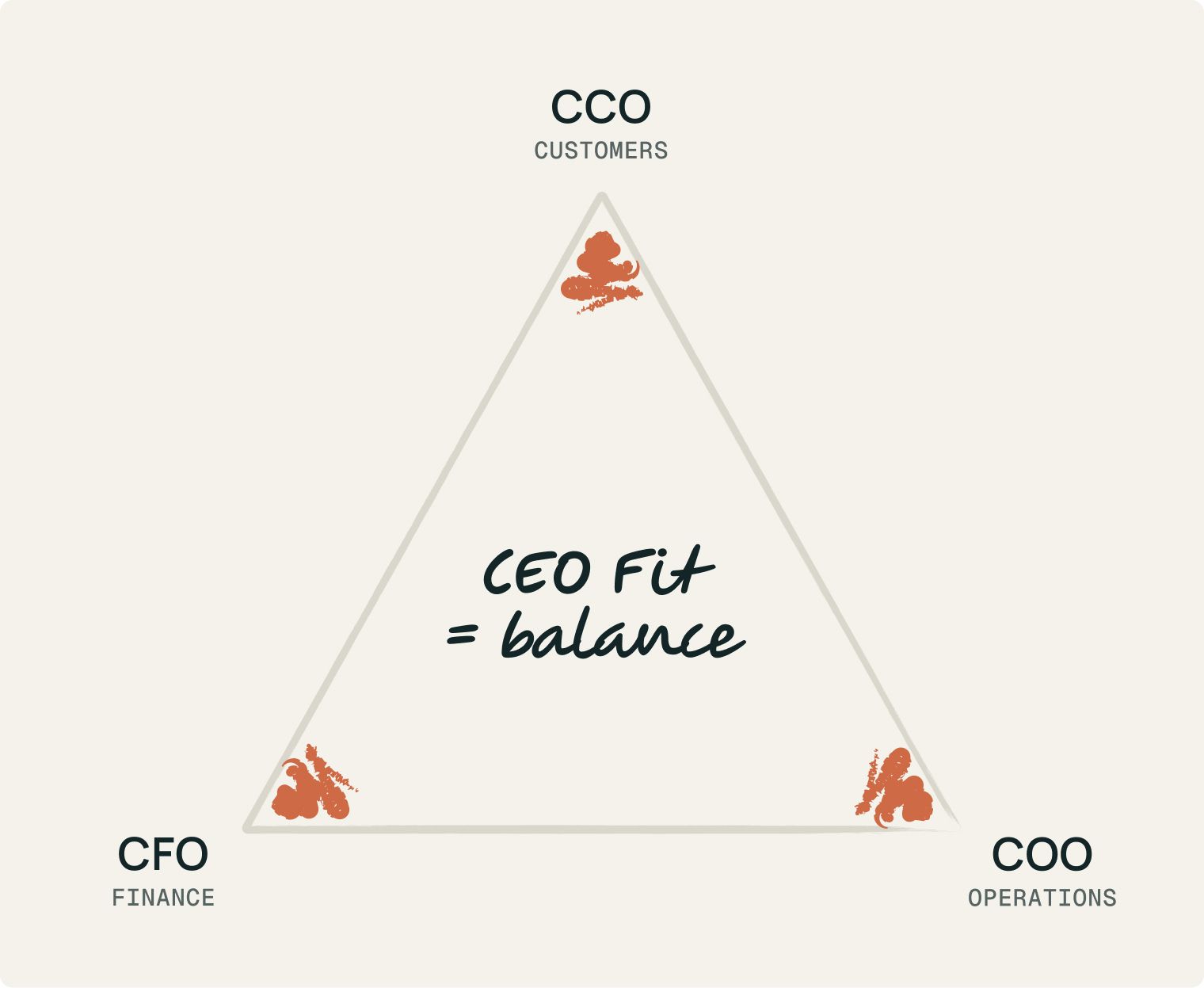

Every small business has three core functions. As the CEO, you’re responsible for all of them:

Getting and keeping customers → acting as the Chief Customer Officer (CCO)

Running operations → acting as the Chief Operating Officer (COO)

Managing finances → acting as the Chief Financial Officer (CFO)

When I talk about the CEO Fit, what I’m really asking is: Are you the right person to wear these three hats for the specific business you’re buying?

It’s not enough to be good at spreadsheets or have deal experience. Investors and brokers don’t care if you can model a 10% CAGR. What matters is whether you can actually run the company once the papers are signed.

Here’s the truth most searchers miss: You don’t have to be world-class at all three roles. However, you do need to be strong in at least one and competent enough in the other two to keep the wheels on. And if you know you’re weak in one area, you need a plan to fill that gap, either with a partner, a senior hire, or by walking away from that business.

I’ve seen too many entrepreneurs ignore this. They buy a business where the daily grind requires skills they either don’t have or don’t want to develop. That mismatch is what leads to burnout and abandonment.

CEO Fit is about looking in the mirror and asking:

Am I the right CCO for this business? (Can I bring in and retain customers?)

Am I the right COO for this business? (Can I run and scale the operations day to day?)Am I the right CFO for this business? (Can I manage the financial engine without blowing it up?)

If your honest answer is “no” to more than one of those, that’s a red flag.

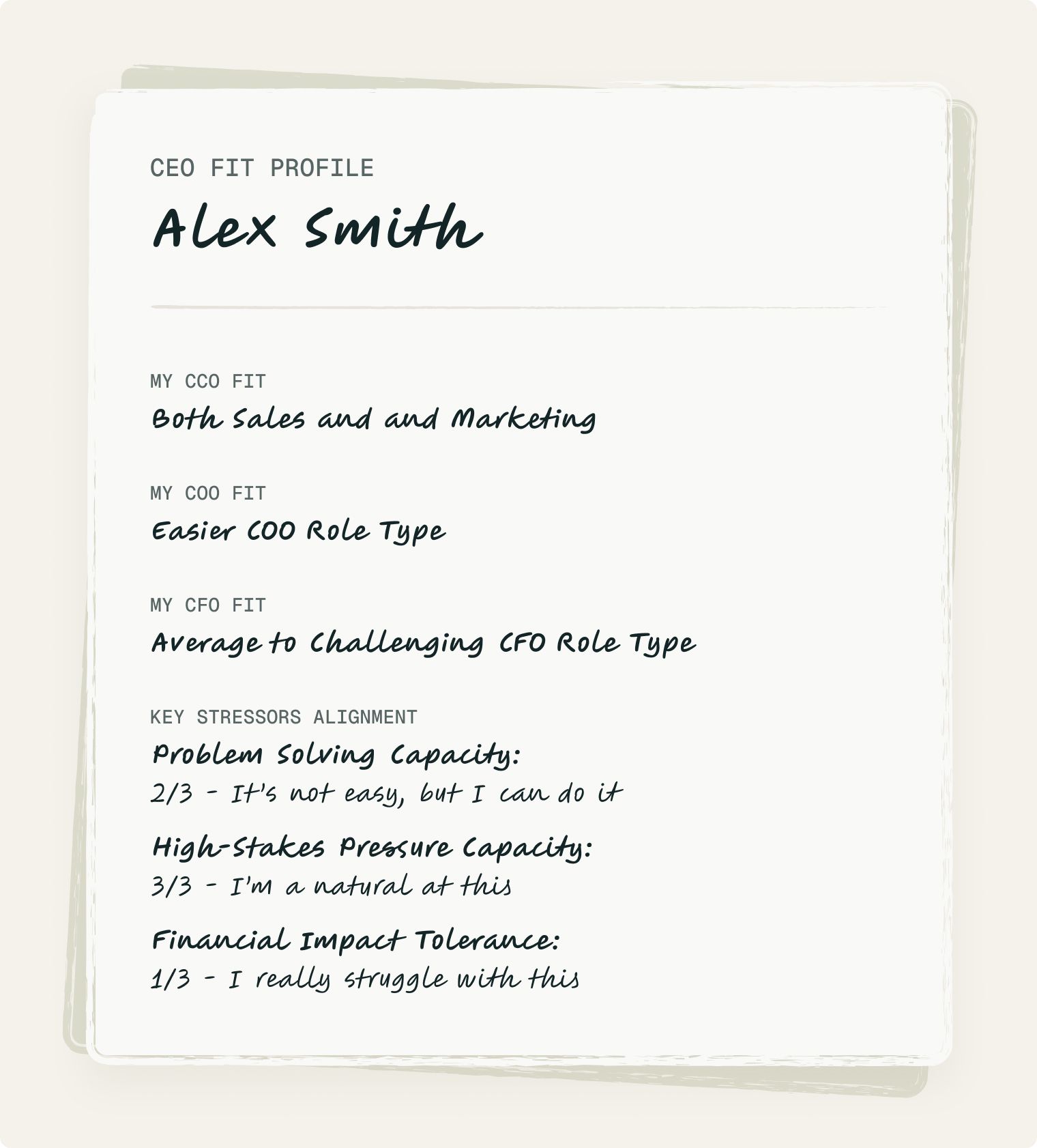

Step 1: Build Your CEO Fit Profile

Before you ever look at EBITDA multiples or debt schedules, you need to know what kind of CEO you actually are. That’s where I start with every buyer who works with me.

I’ve built a process around creating your CEO Fit Profile that is based on four self-assessments (takes about 30 minutes total. It gives you a snapshot of where your natural strengths lie as a CEO and where running a company is most likely to crush you.

Here’s what the profile looks at:

1. Chief Customer Officer (CCO) Fit

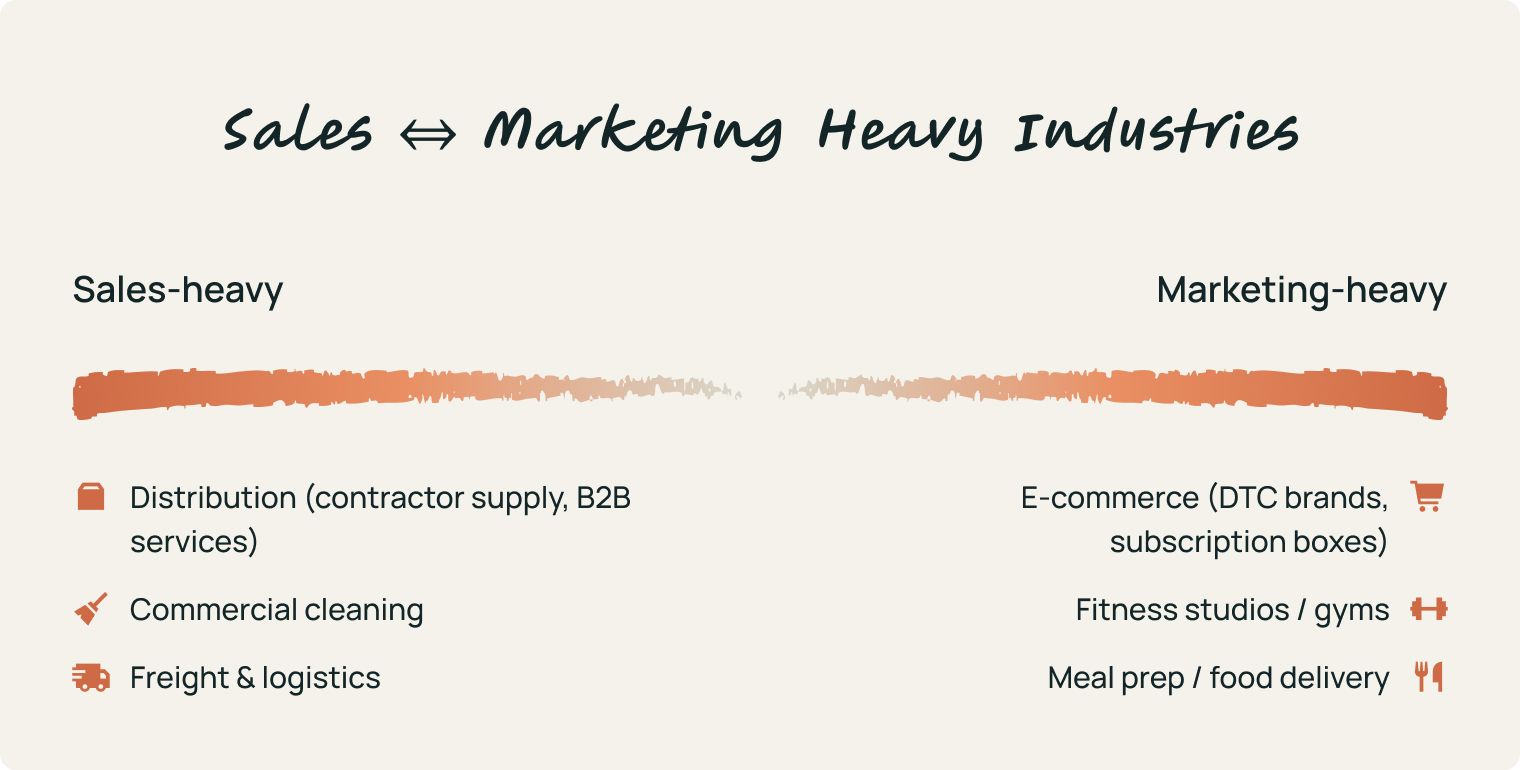

Every business needs to get customers and keep them. But not every business does it the same way. Some rely on a sales-heavy approach, such as cold calls, trade shows, and relationship building. Others use a marketing-heavy approach like SEO, digital ads, and content.

Your first step is to figure out where you fall on that spectrum.

👉 Example: In my own profile, I lean sales-heavy. That means I do better in industries where customer acquisition is driven by relationships, like distribution or B2B services. If you’re someone who geeks out on SEO dashboards or creative campaigns, you’ll probably thrive in a marketing-driven business like e-commerce.

2. Stressor Alignment

This is one of the most overlooked parts of buyer fit. It measures three things:

Problem-solving capacity–Do you like solving simple problems over and over, or can you handle complex, multi-layered issues?

High-stakes pressure capacity–Can you stay calm when customers or employees are upset, or do you shut down?

Financial impact tolerance–Are you okay with small-dollar mistakes, or can you stomach risks where a single screw-up costs 20% of your annual profit?

The reason this matters is that if you can’t handle the problems of the business at its current size, you’ll never want to grow it. Growth doesn’t just multiply revenue, it multiplies problems. A company that doubles in size also doubles the fires you need to put out.

👉 Example: When I ran a meal prep company, problems were easy to solve. If we messed up, we just remade the order—low stress, low stakes. But when I ran a furniture import business, one mistake could mean a container full of goods had to be remade overseas and shipped again, wiping out all the profit on a big order. That level of stress was a terrible fit for me, and it eventually made me physically ill.

3. Chief Operating Officer (COO) Fit

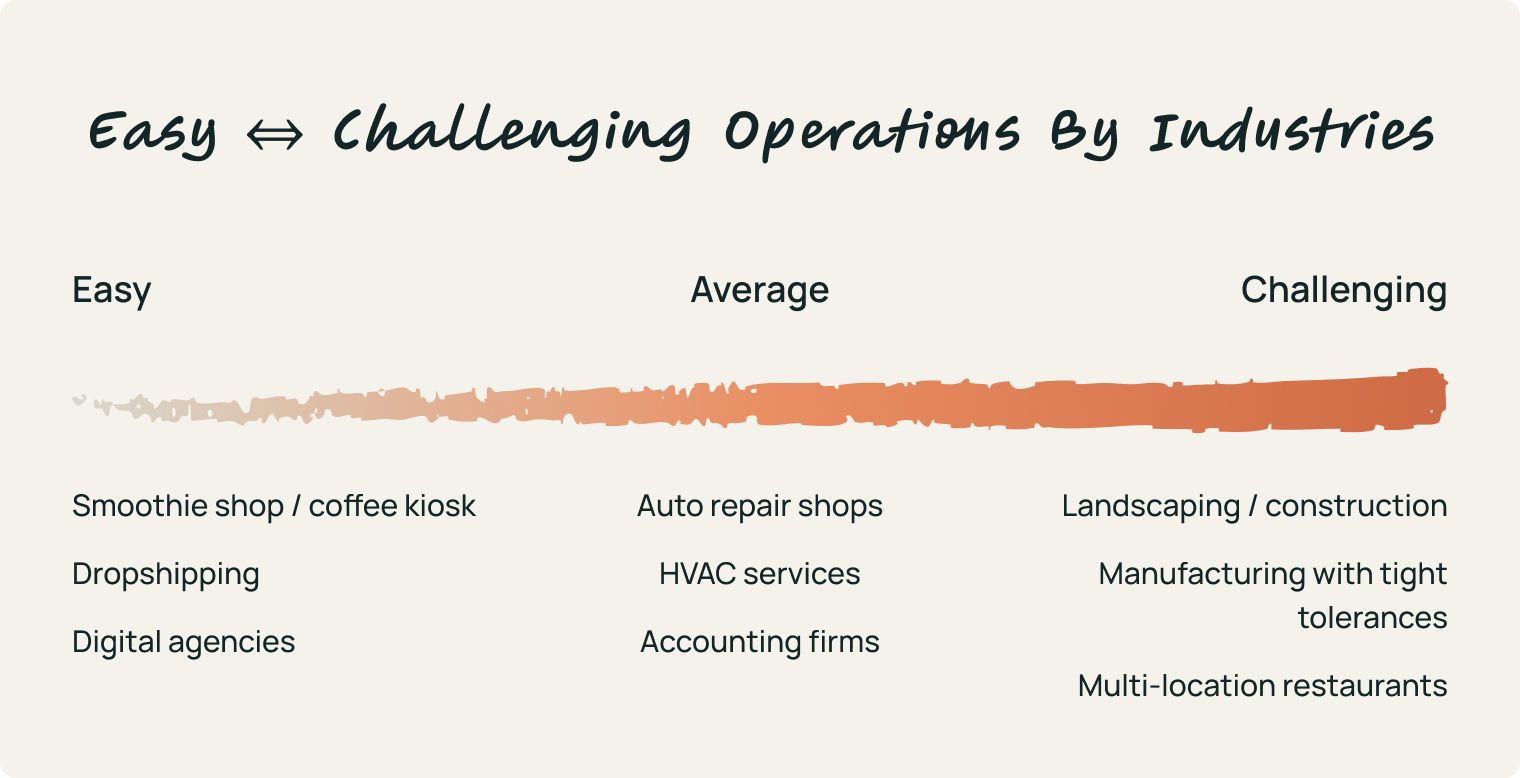

Operations vary wildly in complexity. Some businesses can be systemized easily, while others are messy by nature.

Challenging COO roles: Landscaping, construction, and manufacturing with tight tolerances; Lots of moving parts, hard to systemize, high error risk.

Average COO roles: Service businesses with some process maturity; Moderate complexity, solvable with good systems.

Easy COO roles: E-commerce dropshipping or a smoothie shop; Highly systemized, predictable, low margin of error.

👉 Example: If you hate firefighting problems, don’t buy a landscaping company, or you’ll burn out. But if you love building systems and handling uncertainty, those businesses might energize you.

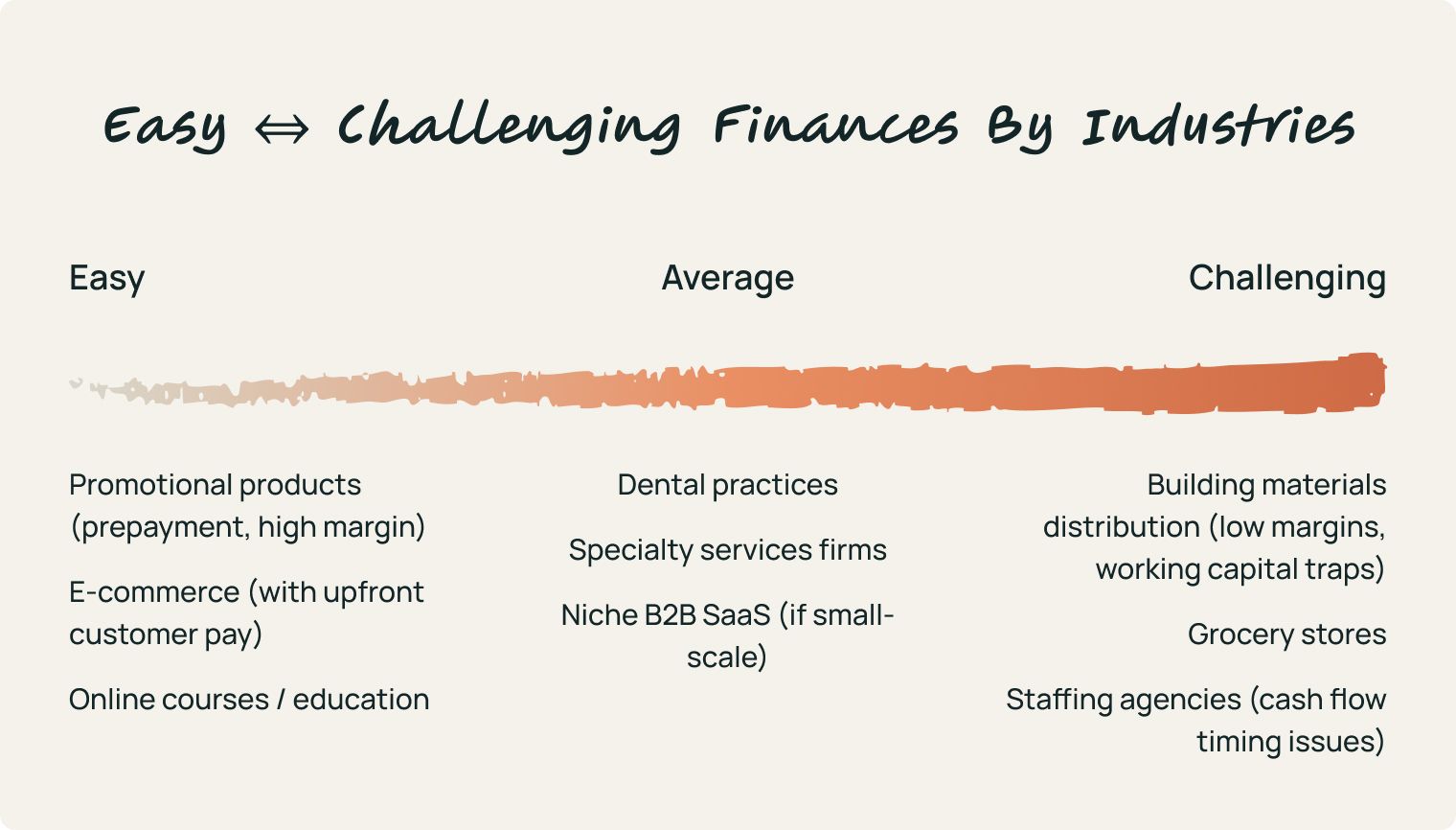

4. Chief Financial Officer (CFO) Fit

Finance intensity comes down to two factors: gross margins and the cash conversion cycle.

Challenging CFO roles: Low margins + positive cash conversion cycle; You’re always juggling cash, and one bad month can sink you.

Easy CFO roles: High margins + negative cash conversion cycle; Customers prepay, you’ve got a buffer, and finances are straightforward.

👉 Example: In my promotional products business (high margin + negative cash cycle), I can review finances twice a month in one Google Sheet—that’s an easy CFO role. But in my building materials distribution business (low margin + cash complexity), the CFO role was challenging. I knew I’d struggle, so I partnered with someone stronger in finance. Without him, I would have blown that business up.

Your CEO Fit Profile is about brutal honesty. It tells you where you’ll naturally thrive, where you can stretch, and where you’re going to need support. Most importantly, it gives you a filter for looking at businesses so you don’t buy something that will drain you.

Step 2: Analyze the Business With AI

Once you understand your personal CEO Fit Profile, the next step is to analyze the business itself. You need to know what kind of CEO the business requires and then compare that to your fit.

To make this process easier, I built a custom GPT that evaluates a business’s “CEO needs.” You feed it a short description of the business (a couple of paragraphs plus some basic financials), and it outputs the type of CEO that business demands.

Here’s how it works:

You don’t need to upload full diligence models or data rooms.

Two pages of info are usually enough: what the business does, how it acquires customers, and high-level financials.

The GPT then breaks down the business across the same three functions: CCO, COO, and CFO, and Stressors

Example: Building Materials Distribution Business

Let’s walk through a real example.

When I analyzed a building materials distribution business, here’s what the AI showed me:

Chief Customer Officer (CCO) Fit

Sales-focused with moderate marketing—Why? This business lives and dies by contractor relationships, repeat orders, and outbound sales, not clever ad campaigns.Chief Operating Officer (COO) Fit

Average-to-challenging operations role—You’re managing logistics, inventory, delivery schedules, weather disruptions, and equipment. It’s not impossible to systemize, but it takes effort.Chief Financial Officer (CFO) Fit

Challenging finance role—Low margins and a complex cash cycle mean you need strong financial oversight. One slip on working capital, and you can burn through cash fast.

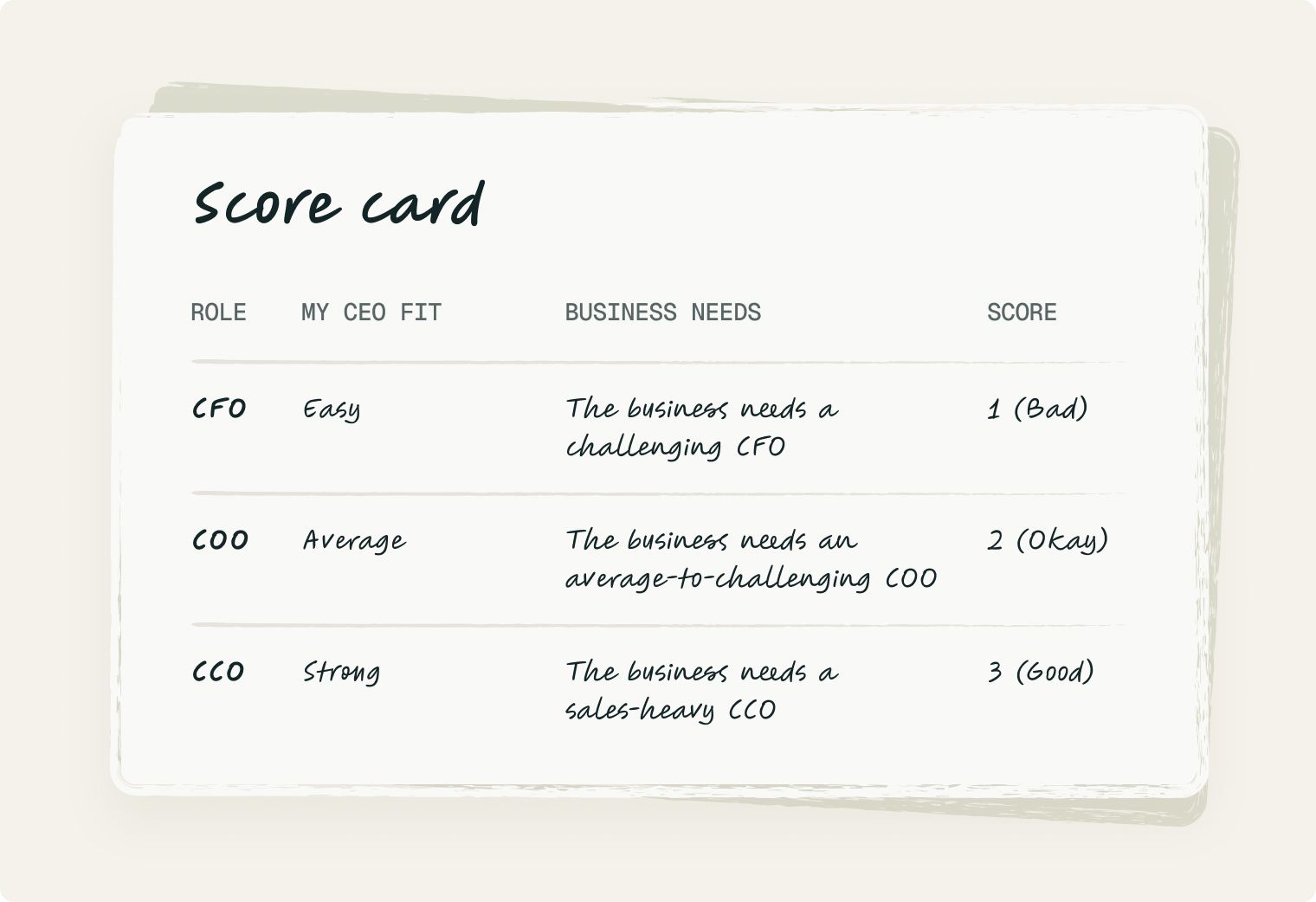

Step 3: Score the Fit

Now you’ve got two things:

Your CEO Fit Profile (what you bring to the table).

The business’s CEO needs (what it demands of you).

The last step is to line them up and score the fit. I use a simple 1–3 scoring system:

1 = Bad fit → Big gap. You’ll either burn out or blow up the business. Walk away, or only move forward if you have a partner who fills the gap.

2 = Okay fit → You’re not a natural, but you can grow into it. This usually means more stress or the need for strong support systems.

3 = Good fit → Strong alignment. This is where you’ll thrive and actually enjoy running the business.

Example CEO Fit Profile

To make this concrete, let’s match the building materials distribution business to my own CEO Fit Profile using the GPT model. Here’s how I stacked up across the key leadership roles:

What to Do With the Scores

Once you have the scores, you can make an informed decision:

If you’re looking at a string of 1s, that’s your signal to walk away. Don’t kid yourself, you’ll hate running that business.

If you see 2s and 3s, it’s workable. Just know where you’ll need support.

If you see mostly 3s, that’s a green light, you’re a strong fit.

When I ran this building materials business through my GPT, the results made something crystal clear: I was not a good fit to be its CFO. My personal profile leans toward easier finance roles. If I had bought this company on my own, I probably would’ve ignored the cash traps and driven it into the ground.

Instead, I partnered with someone who’s stronger financially—an ex-aerospace engineer who thrives on detail and caution. He handles the numbers, and I focus on growth and customer relationships.

This scoring system isn’t a perfect science. But it forces you to look beyond “nice EBITDA multiple” or “growing industry” and ask: Can I actually thrive in this business day to day?

Final Thoughts

Most buyers obsess over the numbers—multiples, margins, debt structures. While those matter, the longer I’m in this space, the clearer it’s become: numbers don’t run businesses, people do.

FitDD is about making sure you and the business are a match.

If you’re a sales-driven operator, don’t buy a company that needs a marketing wizard to grow.

If you hate stress, don’t take on a business where one mistake wipes out half the year’s profit.

If you know you’re weak in finance, don’t pretend you can muscle through a low-margin, cash-intensive business.

Your unfair advantage in small business isn’t some hidden moat or clever strategy. It’s you: your skills, your temperament, your ability to stay in the game when things get hard.

I wish I had this framework when I bought my first business. It would’ve saved me from years of frustration and the health scares that came with running a business that was a bad fit. That’s why I built FitDD, and why I share it.

Because at the end of the day, the goal isn’t just to buy a business. The goal is to buy the right business that works for you, not against you.

If you want the self-assessments or access to the GPT I’ve built, reach out to me on Linkedin. I’ll send you everything you need to run the analysis yourself.

Big thank you to Bhushan Lele for sharing his insights in the Mainshares Network! You can follow him on Linkedin to learn more.

Join our upcoming live workshops

Every week, we host tactical sessions with experienced operators and deal experts. Connect with 3,000+ SMB buyers, investors, and owners inside the Mainshares Network.