- SMB Signal by Mainshares

- Posts

- 📡 SMB Signal: 3 New Deals, 2 Community Wins & Tips on Pursuing Deals

📡 SMB Signal: 3 New Deals, 2 Community Wins & Tips on Pursuing Deals

Plus, open office hours, community meetups and more

Hello, and welcome to 📡 SMB Signal by Mainshares! Each week, we spotlight high-quality small business deals, operator insights, and tactical playbooks for buying, running, or investing in Main Street businesses. Join 12,000+ investors and operators staying sharp and deal-ready.

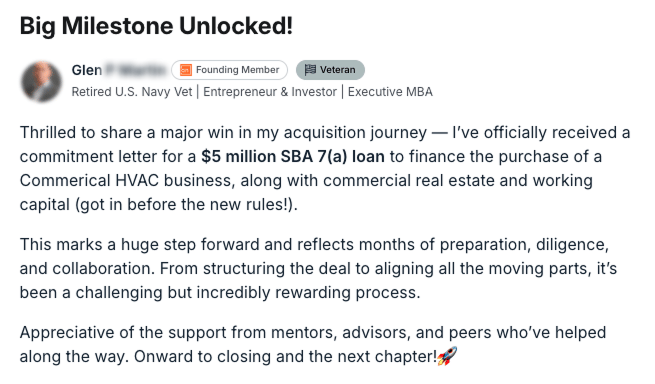

🎉 Network wins

Big wins this week! Shout out to these Mainshares Network members hitting major milestones!

🔍 What’s in the Deal Depot?

Looking to invest? Check out some of the latest SMB investment opportunities. 👉 Sign up on Mainshares to access live deal details.

1. Public Adjusting Platform

📈 Investment Opportunity

Location: Florida

Cash Flow: $1.7M

LTM Revenue: $4.8M

TLDR: A seasoned sponsor is acquiring a high-growth public adjusting business that helps individuals and businesses secure fair property insurance payouts. With a 30% CAGR, strong EBITDA margins, and over 1,000 claims managed since 2022, the company is well-positioned for continued expansion, especially as new legislation shifts market share from contractors to public adjusters.

Why is this interesting?

Policy tailwinds—New state laws are reshaping the industry, and this firm is already embedded in key referral networks like property managers and contractors.

Fragmented market, big upside—No dominant national player creates significant white space for growth via roll-ups.

Efficient model, proven team—Lean cost structure, scalable platform, and a founder staying on to drive the next chapter.

Looking to acquire? If you’re actively searching, 👉 fill out your Buyer Profile to get matched with opportunities that fit your search criteria—or email us directly to learn more about a specific opportunity.

Here are a few standout small businesses actively seeking an operator to take the reins:

2. Custom Cabinet Manufacturer

🔑Buyer Opportunity

Location: Idaho

Cash Flow: $900k

LTM Revenue: $3.6M

Asking Price: $2.7M

TLDR: This opportunity is a fast-growing, custom cabinetry and millwork business with deep roots in Idaho’s booming residential construction market. Known for precision craftsmanship and 80% repeat customer rate, the company has expanded production capacity with CNC automation and added closet systems and modern cabinetry to its product mix. Now operating at capacity, it’s poised for immediate growth with a larger facility or expanded team.

Why is this interesting?

Strong growth with margin—Cash flow grew 61% YoY; 2025 projected to cross $1M at ~23% margin.

Deep client relationships—80% repeat rate from contractors, designers, and homeowners; no marketing required.

Skilled team in place—14 hourly staff, plus trained leadership and install techs; minimal owner dependency.

Asset-rich sale—Includes ~$418K in equipment and inventory, including CNC, edge bander, trucks, and tools.

3. Profitable Painting Contractor

🔑Buyer Opportunity

Location: Wyoming

Cash Flow: $600k

LTM Revenue: $1.8M

Asking Price: $1.9M

TLDR: This opportunity is a well-established, locally dominant painting contractor in Jackson, Wyoming, specializing in high-end residential and commercial interior/exterior painting. With no formal marketing or website, the business runs entirely on word-of-mouth, executing projects through autonomous crew leads and generating 3x EBITDA margins.

Why is this interesting?

Simple and profitable—33%+ adjusted cash flow margin with minimal overhead and strong pricing power.

Crew-led structure—10 full-time staff organized into three independent crews with low turnover and strong leadership.

Zero marketing dependency—No paid ads or formal lead gen; steady inbound demand from loyal client base.

Relocatable & low CapEx—No real estate obligation; fully portable model with efficient equipment base.

Growth-ready—New ownership could unlock additional margin through digital presence, sales support, or geographic expansion.

Deal summaries above are for informational purposes only. Detailed financials and confidential information are shared only with vetted buyers under an executed NDA.

🎥 Upcoming events

🗓️ Thursday, June 19

👤Host: Sam Domino and Marco White, Buying With Mainshares

🕛 12 PM CT / 1 PM ET

👉Register now

Thinking about owning a business but not sure where to start? Join the Buying with Mainshares team for a tactical lunchtime office hours session. Sam and Marco will give an insider's look at how to actually find a business to buy, from sourcing deals to spotting red flags and building relationships with sellers. They’ll share real-world tactics and stories to help you get unstuck and start taking action.

Whether you're actively searching or just exploring, this session is packed with practical advice, Q&A, and candid insights from people who’ve been in your shoes.

🔑 Top questions asked this week

Every week, we pull real questions straight from Mainshares Network, where small business buyers, investors, and operators swap notes, deals, and advice in real time. Here are some of the top insights from the week.

What’s the risk of acquiring an owner-dependent business?

Q: From the #AskSMB channel

A: Matthias Smith (Mainshares Advisor)

Hi Tianie—Based on the details you’ve provided, I would advise approaching this deal with significant caution—if not passing on it altogether.

With only two employees (the seller and his son) and an SDE of $124,000, this business appears to be highly dependent on the owner. In situations like this, a substantial portion of the company’s goodwill—particularly in client relationships and sales—tends to reside with the seller personally. Once the seller exits, there’s a real risk that much of the revenue could walk out the door with him, even if his son remains involved in the short term.

Deals of this size and earnings profile are especially susceptible to key-person risk, and without a robust transition and continuity plan—or evidence that the son is truly capable and committed to maintaining operations—it's difficult to justify the purchase price or have confidence in future performance.

In short, unless you can clearly mitigate that owner-dependence, it may be wise to keep looking.

Wishing you all the best as you continue your search.

How do you know when a deal isn’t worth pursuing?

Q: From the How to Buy a Business for $1 Webinar

A: Yoseph Israel, Founder of Skip the Startup

I’ve gone through typically about 10 to 15 deals a month. Of those, maybe one to three come out the other end. I call it kissing frogs.

If you’re starting from scratch and don’t have any capital, you’re going to kiss a lot of frogs—because you’re mostly looking at distressed deals. But if you do have capital—and that’s what’s so great about Mainshares—you’re going to close more deals successfully and faster because of access to capital.

The key is combining access to capital with rapport. Most buyers just show up and throw out a number. But if you build trust and actually connect with sellers, you’ll stand out. That’s the edge.

This came from Yoseph’s live session, “How to Buy a Business for $1.” Join the Mainshares Network to watch the full replay.

Got a question? Submit your question in the community!

📑 More Resources

How to Build Your Buy Box: A Guide for Business Buyers (Article)

Building a Deal Flow Machine with Christi Loucks (Article)

Building a Deal Model From a CIM (Live Workshop)

Owners After Hours with the American Operator (Austin Meetup)

Investors & Searchers Mix & Mingle (Austin Meetup)

🎙️ Latest podcast episode

Join 3,000+ SMB buyers, investors, and advisors building Main Street businesses

Get access to vetted deal flow, live workshops, and a private network of people serious about SMB acquisition.